Japan’s SoftBank Group reported annual net profit of ¥1.15tn ($7.87bn) for the year ending March 31, 2025, its first since 2020.

In the latest quarter, the company reported a 240 percent quarter-on-quarter increase in its net profit to ¥520bn ($3.53bn). This rounds out a volatile year, which zigzagged between net profit and net loss.

SoftBank’s Vision Funds, the investment vehicles it controls, also made a net profit of ¥434bn ($2.98bn) for the financial year despite being down 40 percent YoY. The final quarter saw a net profit of ¥177bn ($1.21bn), up from the ¥352bn ($2.41bn) loss the previous quarter.

The fiscal year saw SoftBank aggressively pursue investments across the AI industry.

In January, Masayoshi Son’s firm said that it would “immediately” invest $100bn in Stargate, the data center company formed by OpenAI, alongside other investors like Oracle and MGX. SoftBank’s individual contribution is around $19bn. That total investment is supposed to rise to $500bn over the next four years, but details remain unclear.

In response to questions about the effect of US tariffs on Stargate’s financing, CFO Yoshimitsu Goto said that “things are changing every day… But I don’t think the tariff itself is going to stop the project’s progress… We would like to wait and see a little bit.”

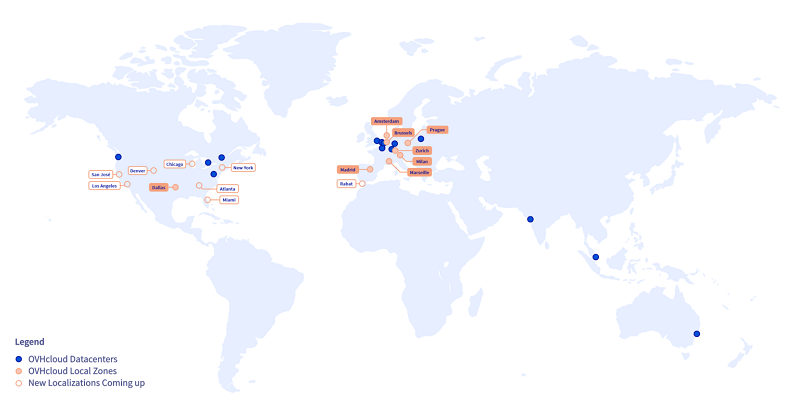

The company’s additions to its data center portfolio included its investment in Dayone, the Singapore-based international arm of Chinese data center firm GDS, in December. It also plans to buy a former Sharp factory in Japan for $676m to convert it into a 150MW AI data center.

SoftBank also managed to announce its additional investment of up to $30bn in OpenAI hours before the close of the financial year. The first funding, finished in April, saw SoftBank invest $10bn in the ChatGPT developer, with an extra $20bn on the way later this year.

$10bn of that remaining investment was originally tied to OpenAI restructuring as a for-profit venture. In May, OpenAI said that the company would not become for-profit, initially appearing to have failed to meet SoftBank’s criteria – however, at the same time, the company removed the ‘cap’ on its for-profit subsidiary, which will become a public benefit corporation (PBC) like Anthropic and xAI.

Goto seemed relatively optimistic in response to queries about SoftBank’s conditional investment, saying: “I don’t think that [the announcement] was a wrong direction, a bad direction,” and that “[SoftBank’s] investment is in the business vehicle.”

He also added that “we are just to wait and see what will happen, not really just on a negative term, but positive term.”

Additionally, SoftBank announced a partnership with OpenAI to develop and sell ‘Cristal intelligence,’ an enterprise AI offering focused on accelerating the development and adoption of AI agents in the workforce.

Chip-related moves include the whole acquisition of Graphcore, a British chip designer, for an undisclosed amount, and Ampere, a developer of Arm-based CPUs for data centers, for $6.5bn. SoftBank bought Arm in 2016 for $32.2bn and currently owns around 90 percent of the company after its 2023 IPO.